The WDC Stock Hype: Is It Real or Just Another Earnings Trap?

Of course. Here is the feature article, written from the persona of Nate Ryder.

*

Western Digital's AI-Fueled Rocket Ship: Are We All Just Along for a Ride to Nowhere?

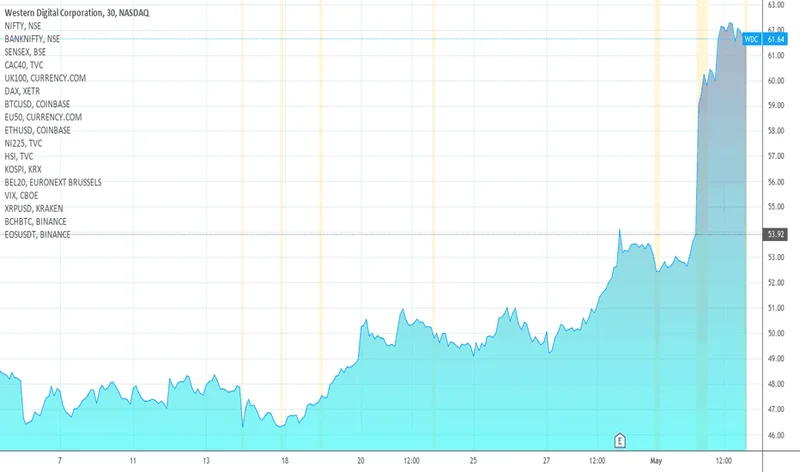

So, let me get this straight. Western Digital, the guys who make the hard drives humming away in some forgotten corner of a data center, is suddenly the hottest ticket in town. The stock is exploding, hitting all-time highs (a fact confirmed by recent reports that Western Digital (WDC) Soars to Fresh High on Q3 Earnings), and Wall Street analysts are tripping over themselves to slap a bigger price target on it. Morgan Stanley says $171. Evercore ISI says, "Hold my beer," and screams $190.

And why? Because of two magic letters: A. I.

Give me a break.

I can almost picture the conference call: some VP in a crisp, unwrinkled shirt, leaning into the microphone and saying the magic word—"AI"—as the stock chart on the screen behind him turns a beautiful, profitable green. Suddenly, a company that makes physical, spinning platters of metal is a futuristic tech messiah. It’s a brilliant marketing pivot, I’ll give them that. But are we really buying this? Are we supposed to believe that the company whose revenue declined by almost 11% last year is now the cornerstone of the artificial intelligence revolution?

This whole thing feels less like a sound investment and more like a high-stakes game of musical chairs. Everyone’s dancing while the music’s playing, but we all know how it ends.

The AI Magic Wand

Let’s be real. Calling Western Digital an "AI stock" is like calling the guy who sells shovels a "gold mining tycoon." Sure, he's essential to the operation, but he ain't the one striking it rich. The story goes that the explosion of AI and cloud computing is creating an insatiable demand for data storage. Hyperscale providers are desperate for high-capacity hard disk drives (HDDs), and WDC is there to sell them. With one-year lead times to get these drives, there's a massive "pent-up demand."

It's offcourse a beautiful narrative, and it’s not entirely wrong. AI models are data hogs, and that data has to live somewhere. And yes, about 80% of it still lives on old-school HDDs. WDC is leaning into this hard, opening new testing labs and investing a billion dollars in Japan to make their drives denser and faster. They’re selling the picks and axes for the digital gold rush. It's a solid, understandable business model.

But is it revolutionary? Is it worth a 116% stock surge in a year?

The problem is that "selling shovels" is a great business right up until someone invents a better way to dig, or the gold runs out. WDC is betting the entire farm on the continued dominance of HDDs for mass storage. They spun off their flash memory business, SanDisk, to double down on this. It’s a sign of confidence. No, that’s not right. It’s a sign of necessity. They’re all-in on a single hand, and if the technology shifts or a competitor (or even a new technology we haven’t seen yet) comes along with a cheaper, more efficient solution for mass data storage... well, you get the picture.

Let's Look Under the Hood for a Second

When you peel back the slick "AI beneficiary" sticker, the engine underneath looks a little... rickety. We're talking about a company with $4.7 billion in long-term debt. Yes, they’ve made moves to reduce it, but that’s a heavy anchor to drag around, especially when you’re trying to innovate. It limits your ability to make acquisitions or weather a downturn. It means you have to keep generating cash just to service your obligations.

And while everyone’s cheering the 50% jump in revenue over the past year, they seem to have collective amnesia about the 10.93% drop the year before. This isn't a story of steady, unstoppable growth; it's a story of volatility. It’s a company riding a wave. And waves, by their very nature, eventually break.

The whole thing is propped up by this echo chamber of analyst upgrades and positive sentiment. Lynx says buy. Morgan Stanley says buy. Evercore says buy. It becomes a self-fulfilling prophecy. The price goes up because they say it will, which makes them look smart, which encourages more people to buy. I've seen this movie before. It’s a fun watch, but the ending is usually a mess.

They're talking about hitting a 43% gross margin by 2027, fueled by "customer commitments and improved manufacturing efficiencies." Translation: We hope our biggest customers keep buying, and we’re going to squeeze every last penny out of our operations. It’s a plan, I guess. But it’s not the kind of world-changing vision that justifies the insane valuation the market is giving it right now. Then again, maybe I'm the crazy one here. Maybe a company with a price-to-sales ratio of over 4, in the hardware business, is a perfectly sane investment.

It's a Great Story, Until It Isn't

Look, I'm not saying Western Digital is going to implode tomorrow. They're selling a necessary product into a hot market, and they'll probably make a lot of money doing it for a while. This momentum could carry the stock even higher. But don't fool yourself into thinking you're investing in the next NVIDIA. You're buying into a cyclical hardware company that’s having a very, very good moment, wrapped in the sexiest marketing buzzword of the decade. The entire bull case rests on the idea that the demand for HDDs is a permanent structural shift, not a temporary peak. And that's a hell of a bet to make. When the music stops, make sure you have a chair.

- Search

- Recently Published

-

- Duke Energy: What's Really Going On?

- Value City Furniture: Are they finally going out of business? The bankruptcy talk.

- Scott Bessent: Who Is This Guy, The Trump Whispers, And What Are They Not Telling Us?

- American Signature Files Chapter 11: What Happened?

- Tesla Ride-Hail in Arizona: What This Means for the Future of Mobility

- OECD: What it is, and its AI Data Focus

- Nebius: Stock, Coreweave, & Nvidia – What's the Real Deal?

- Bitcoin: Beyond the Headlines, What This Moment Truly Signals

- Social Security Retirement: The Realities of Your Payouts and How to Plan

- Starlink Satellites: How Many Are Really Up There, Where They're Hiding, & What's The Actual Point?

- Tag list

-

- carbon trading (2)

- financial innovation (2)

- blockchain technology (2)

- carbon tokens (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (29)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (7)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Aster (8)

- Zcash (6)

- iren stock (3)