ASML vs. China's Export Controls: The PR Spin vs. the Real Risk to Investors

So, ASML’s money guy, Roger Dassen, gets up and tells the world that ASML is prepared for China's rare-earth export controls — finance head says company has stock thanks to long lead times. You can almost hear the sanitized, pre-approved confidence dripping from every word. "Well prepared." It’s the kind of phrase a corporate drone uses to describe having an extra stapler in the supply closet.

Let me translate this for you. What he’s really saying is, "We’ve got enough stuff stockpiled to keep the machines running for a few months, so please, for the love of God, don’t tank our stock price." He even admits it’s because of their "long production lead times," which basically means they had a bunch of this material on order anyway. This isn't some 4D chess move; it's just the happy accident of a slow-moving supply chain.

And we're all supposed to nod along and feel reassured? Give me a break. This is like bragging you have a full tank of gas as your car is being pushed off a cliff. What happens in month four, Roger? Or month six? Are we just supposed to forget this is happening?

The Slow-Burn Squeeze

Let’s be real. Touting a "couple of months" of supply is like bragging you brought a bottle of water to cross the Sahara. It’s a nice thought, but it completely misses the scale of the problem. This isn't a temporary hiccup. This is a deliberate, calculated squeeze by Beijing, and ASML is right in the crosshairs.

China’s new rules are a masterpiece of bureaucratic warfare. First, they slap export license requirements on key rare earths—holmium, thulium, ytterbium. The stuff that makes ASML's magic boxes go brrrr. Then comes the real gut punch, starting December 1, 2025: any product made outside China with more than 0.1% of its value coming from Chinese rare earths also gets hit.

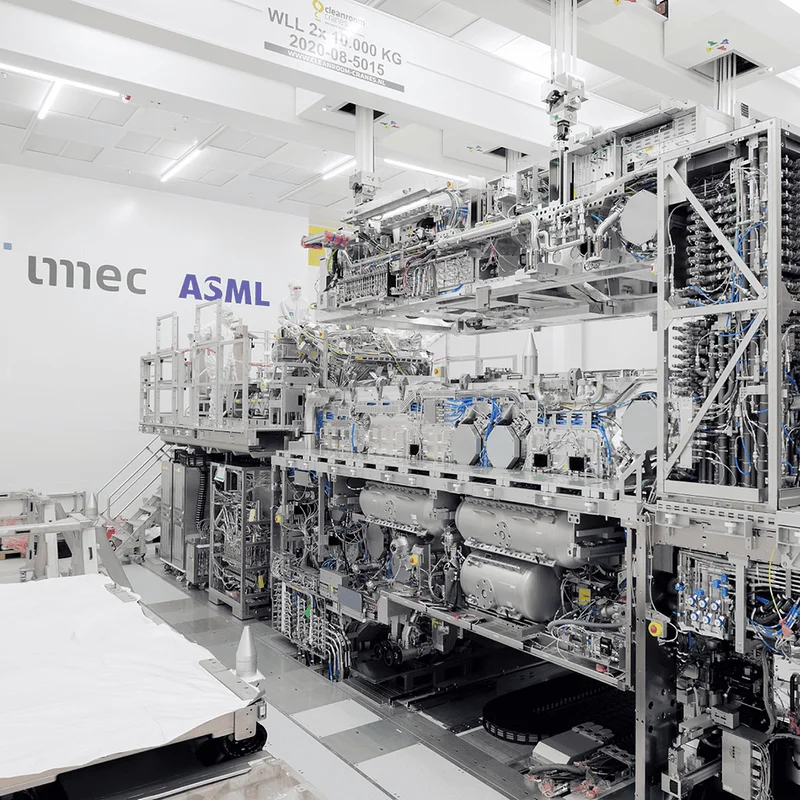

Think about that. It’s an octopus wrapping its tentacles around the entire global supply chain. They’re not just controlling the raw spigot; they're controlling everything that spigot feeds, no matter where in the world it ends up. And ASML, the king of lithography, is utterly dependent on this stuff for its DUV and EUV systems.

So when CEO Christophe Fouquet projects that demand from China will be "significantly lower in 2026," he’s not just making a forecast. He’s reading the writing on the wall. This is a forced decoupling, happening in slow motion. It’s not just about "softening demand from local Chinese chipmakers." That's the PR-friendly version. The ugly truth is that the US government yanking VEU license exemptions for giants like Micron, Samsung, and TSMC is a massive blow. This is a two-front war, and ASML is getting squeezed from both sides.

It’s All Just Theater

The whole thing is just a pathetic piece of corporate theater. You have executives on one side, calmly explaining how they have things under control, and government officials on the other, talking about national security. It’s all nonsense. This is a bad situation. No, 'bad' doesn't cover it—this is a five-alarm dumpster fire for the global tech industry.

I get so tired of this language. It's the same kind of empty talk you hear from a social media company's "Head of Trust and Safety" right after their platform was used to organize a riot. It's meaningless. The real story ain't about supply chain logistics; its about a fundamental shift in global power. We're watching the tech world get carved up into spheres of influence, and companies like ASML are just trying to survive while pretending they have a choice in the matter.

They don’t. The decisions are being made in Washington and Beijing, not in a Dutch boardroom. This projected 2026 demand drop isn't a market trend; it's a political outcome. And the fact that they’re even talking about it now tells me they’re trying to soften the blow for investors when the real numbers hit. They’re managing expectations, which is corporate speak for "get ready, this is going to hurt."

Then again, what are they supposed to do? Come out and say, "Yeah, we're totally screwed"? Offcourse not. So they put on a brave face, talk about their "preparedness," and hope everyone is too busy looking at their phones to notice the ground crumbling beneath their feet. But I notice. And honestly…

What I really want to know is what the internal panic level is. Are they secretly scrambling to redesign components to use fewer rare earths? Are they lobbying governments behind the scenes, begging for a way out of this mess? We never get to see the frantic paddling under the water, just the calm-looking duck on the surface.

This Is What a Tech War Looks Like

Let's stop kidding ourselves. This isn't a trade dispute or a supply chain issue. This is a war. It’s a quiet, bloodless war fought with export controls, licensing agreements, and corporate press releases, but it's a war nonetheless. ASML isn't just a company navigating market forces; it's a strategic asset caught in a geopolitical vise. Their "preparedness" is temporary, their future uncertain, and their public statements are nothing more than battlefield propaganda designed to maintain morale. The real fight is just getting started.

- Search

- Recently Published

-

- Duke Energy: What's Really Going On?

- Value City Furniture: Are they finally going out of business? The bankruptcy talk.

- Scott Bessent: Who Is This Guy, The Trump Whispers, And What Are They Not Telling Us?

- American Signature Files Chapter 11: What Happened?

- Tesla Ride-Hail in Arizona: What This Means for the Future of Mobility

- OECD: What it is, and its AI Data Focus

- Nebius: Stock, Coreweave, & Nvidia – What's the Real Deal?

- Bitcoin: Beyond the Headlines, What This Moment Truly Signals

- Social Security Retirement: The Realities of Your Payouts and How to Plan

- Starlink Satellites: How Many Are Really Up There, Where They're Hiding, & What's The Actual Point?

- Tag list

-

- carbon trading (2)

- financial innovation (2)

- blockchain technology (2)

- carbon tokens (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (29)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (7)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Aster (8)

- Zcash (6)

- iren stock (3)