SMCI Stock Plunge: What Happened and the Internet's Reactions

SMCI's Dip? Nah, It's Just the Launchpad for AI's Next Giant Leap

Okay, folks, let's talk about Super Micro Computer, or SMCI as everyone knows it. I saw the headlines yesterday, you probably did too: "SMCI Stock Plunges After Earnings Miss." The stock took a hit, down over 9% in after-hours trading after their Q1 2026 earnings report. Super Micro Stock Plunges After-Hours After Q1 Double Miss: Investors Shrug Off FY26 Guidance Hike, But Retail Looks To Buy The Dip - MSN Adjusted EPS? Lower than last year, lower than expected. Revenue? Missed the mark. Gross margin? Squeezed tighter than a… well, you get the picture.

But here's the thing: zooming in too close can make you miss the forest for the trees. And in this case, the forest is a sprawling, rapidly growing ecosystem of artificial intelligence. We're talking about a $700 billion cloud backlog fueled by AI. That's not just a trend; it's a tectonic shift. It's like the dawn of the internet all over again, except this time, it's smarter, faster, and exponentially more powerful.

The Bigger Picture: AI's Insatiable Hunger

Let's be clear, any dip in SMCI's stock price is not a reflection of the company's value. It's more like a hiccup on the way to a marathon. Super Micro specializes in building AI-optimized servers, the very backbone of this AI revolution. They're the ones putting together the machines that power Nvidia's and AMD's GPUs.

Think of it like this: in the California Gold Rush, the guys selling picks and shovels made a killing, right? Well, SMCI is selling the picks and shovels for the AI gold rush. And that rush is just getting started. Amazon alone is planning $125 billion in capital expenditures in 2025. That's a lot of picks and shovels.

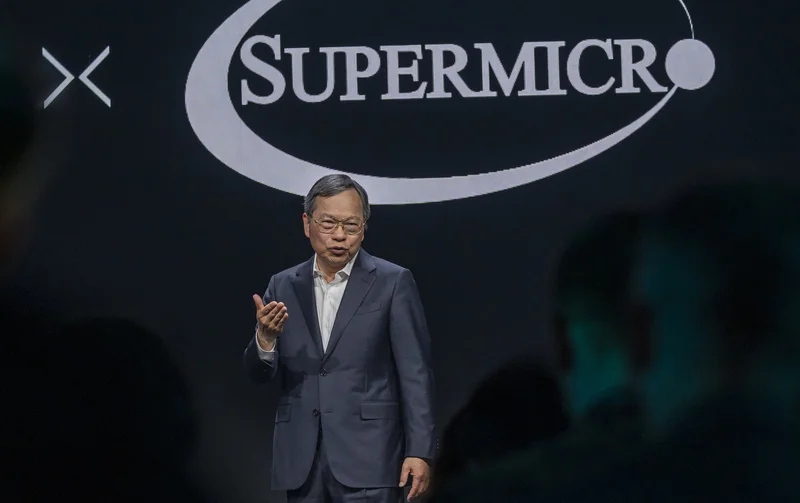

Now, I know what some of you might be thinking: "But Dr. Thorne, the earnings report was disappointing!" And you're right, in a vacuum. But let's look at the context. The CEO himself stated that the order book is expanding rapidly, including over $13 billion in Blackwell Ultra orders. Thirteen billion! That's not just a vote of confidence; it's a declaration of war on the limitations of what AI can achieve.

And what about Taiwan Semiconductor Manufacturing, TSM? Their 3nm and 5nm processes are sold out due to AI demand. Sold out! That's like trying to buy toilet paper in March 2020 – except this time, it's not a temporary panic; it's a fundamental shift in demand. TSM's stock has risen over 52% in 2025, and analysts see even more upside. This isn’t just about one company; it’s about an entire ecosystem firing on all cylinders.

Arista Networks (ANET) is also in the mix, with analysts maintaining a "Strong Buy" rating and projecting significant revenue growth. Their AI networking revenue is expected to jump 70% in 2026. Seventy percent! That's the kind of growth that makes your head spin.

So, SMCI had a rough quarter. So what? The demand for AI infrastructure is not going away. It's accelerating. And Super Micro is right in the thick of it.

I saw a comment on Reddit that really resonated with me: "SMCI is the infrastructure play for the next decade." Spot on. This isn't about short-term gains; it's about building the foundation for a future powered by AI.

But here's the ethical question we need to be asking: are we ready for this future? Are we prepared for the societal shifts that AI will bring? We're building these incredible tools, but we need to ensure they're used responsibly and ethically. The speed of this is just staggering—it means the gap between today and tomorrow is closing faster than we can even comprehend, and we need to be ready.

This Is Just the Beginning

Look, I understand the knee-jerk reaction to sell when a stock dips. But sometimes, the best opportunities come when everyone else is running for the exits. SMCI's dip isn't a sign of trouble; it's a sign of opportunity. It's a chance to get in on the ground floor of something truly transformative.

What does this mean for us? It means we're on the cusp of a new era, an era where AI will touch every aspect of our lives. But more importantly, what could it mean for you? What problems can you solve with AI? What new businesses can you create? What new opportunities can you seize?

Ignore the Noise, Embrace the Future

- Search

- Recently Published

-

- Duke Energy: What's Really Going On?

- Value City Furniture: Are they finally going out of business? The bankruptcy talk.

- Scott Bessent: Who Is This Guy, The Trump Whispers, And What Are They Not Telling Us?

- American Signature Files Chapter 11: What Happened?

- Tesla Ride-Hail in Arizona: What This Means for the Future of Mobility

- OECD: What it is, and its AI Data Focus

- Nebius: Stock, Coreweave, & Nvidia – What's the Real Deal?

- Bitcoin: Beyond the Headlines, What This Moment Truly Signals

- Social Security Retirement: The Realities of Your Payouts and How to Plan

- Starlink Satellites: How Many Are Really Up There, Where They're Hiding, & What's The Actual Point?

- Tag list

-

- carbon trading (2)

- financial innovation (2)

- blockchain technology (2)

- carbon tokens (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (29)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (7)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Aster (8)

- Zcash (6)

- iren stock (3)