The Great Mortgage Rate Reset: What Today's New Rates Mean for Your Future Home

The national conversation around housing has felt… stuck. For the better part of two years, we’ve been collectively holding our breath, staring at numbers on a screen that seemed designed to induce paralysis. The faint hum of the refrigerator is the only sound in countless kitchens as families gaze at listings, then at their own mortgage statement, and realize they’re caught. They’re living in the era of the “golden handcuffs”—shackled by an impossibly low interest rate from a bygone era, making the dream of moving not just expensive, but financially illogical.

Today, the average for `30 year mortgage rates` sits at 6.156% (Current mortgage rates on October 29, 2025). On the surface, it’s just a number. A slight dip from a month ago, a tiny nudge up from last week. But I believe this number represents something far more profound. It’s not just a data point; it’s the sound of a key turning in a lock that has been rusted shut. We are at an inflection point, a moment where the great stasis of the American housing market is showing the first signs of breaking. The question is no longer if things will change, but what the world looks like after they do.

The Ghost of 3 Percent

To understand where we’re going, we have to be brutally honest about where we’ve been. The period from 2020 to early 2022, when `mortgage interest rates` plunged to historic lows, wasn’t a normal market cycle. It was an anomaly, a black swan event fueled by a global pandemic and unprecedented government intervention. When I first saw the data back in early 2021, with rates bottoming out at 2.65%, I knew this wasn't just a market event. This was a societal event, a once-in-a-generation fluke that would create echoes for decades.

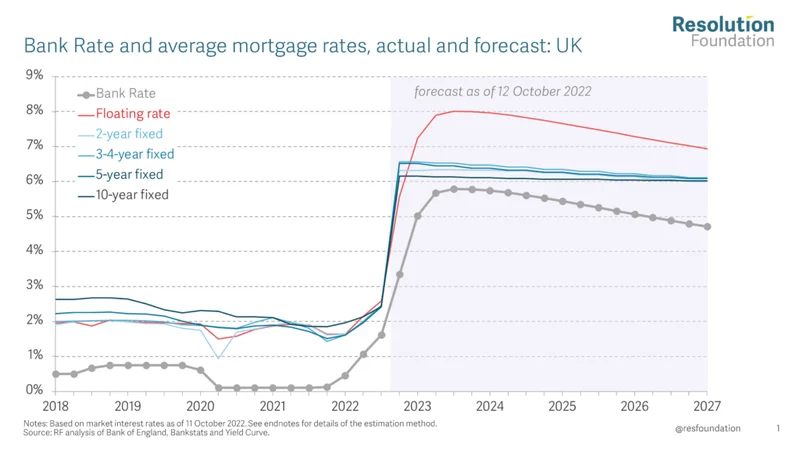

Those rates were like the Homestead Act of the digital age, granting a huge swath of the population a form of financial territory—a sub-3% mortgage—that may never be available again in our lifetimes. This created a psychological anchor that has been dragging down the entire market. We became obsessed with a number that was never meant to last, judging today’s reality against a phantom. The subsequent whiplash, with rates soaring past 7% by January of this year, felt like a betrayal. But was it? Or was it simply a return to a historical norm we’d forgotten?

This fixation is the core of the golden handcuffs problem. Millions of people are in homes that no longer fit their lives—too small for a growing family, too big for empty nesters, too far from a new job. Yet they stay put, because giving up a 2.8% rate for a 6% or 7% rate feels like economic self-sabotage. This has created a supply crisis not of construction, but of circulation. The entire system has been constipated. But what if the cure isn't a return to the past, but an adaptation to the future?

The First Cracks in the Ice

For months, the market has been a frozen river, beautiful but static. The recent moves by the Federal Reserve, including the quarter-point cut in September, are the first signs of a thaw. The recent dip in `today mortgage interest rates` to around 6.15% isn't a flood, but it's the sound of cracking ice. It’s the beginning of movement. And this is where my genuine excitement kicks in, because stagnation is the enemy of progress.

Now, the Fed’s actions are complex. Everyone focuses on the federal funds rate, but we also have to watch its balance sheet—in simpler terms, that’s the massive portfolio of bonds and mortgage-backed securities it holds. As the Fed lets that portfolio shrink, it tends to push long-term rates like mortgages up, which is why the Fed’s rate cuts haven’t created an immediate nosedive in what you pay for a home loan. But the signal is what matters. The overarching trend has shifted from tightening to easing, and that psychological shift is monumental. The recent Fed Cuts Interest Rate Again as Layoffs Mount: What It Means for Mortgages as Markets React - Realtor.com are the first real sign of life we've seen in ages and it suggests a potential thawing of this frozen market—a sign that maybe, just maybe, the gears of the housing world are starting to grind back into motion after being seized up for so long.

This is the moment for us to recalibrate our expectations. If you’re waiting for 3% to come back, you’re waiting for a ghost. But if you’re looking for a path forward in a 5.5% to 6.5% world, that path is starting to appear. For potential buyers, this means the game is back on, albeit with new rules. Your credit score is no longer a suggestion; a 740+ score is your ticket to the best possible terms. Your debt-to-income ratio isn’t just a metric; it’s the foundation of your financial health. Shopping around for a lender isn't just smart; it's non-negotiable, potentially saving you thousands a year.

But what does this new era of movement really look like? If the old American dream of climbing the housing ladder every seven years is broken, what replaces it? Are we becoming a nation of long-term nesters, more focused on renovating and adapting our current spaces than on moving?

The Great Readjustment Has Begun

Let’s stop mourning a world that no longer exists. The 3% mortgage is gone. It was a beautiful, bizarre moment in history, but it’s over. The real work, the exciting work, begins now. We have to stop seeing today's rates as a problem and start seeing them as the new foundation upon which we must build.

This isn’t a crisis; it’s a paradigm shift. The challenge for our generation won't be finding the perfect starter home to flip in five years. It will be about reimagining the very concept of "home" as a place of permanence. The next wave of innovation won't be in exotic financial products, but in modular additions, sustainable retrofitting, and technologies that allow our homes to evolve with our families. We must shift our focus from "moving up" to "rooting down." This is the great readjustment, and it’s time we embraced it.

- Search

- Recently Published

-

- Duke Energy: What's Really Going On?

- Value City Furniture: Are they finally going out of business? The bankruptcy talk.

- Scott Bessent: Who Is This Guy, The Trump Whispers, And What Are They Not Telling Us?

- American Signature Files Chapter 11: What Happened?

- Tesla Ride-Hail in Arizona: What This Means for the Future of Mobility

- OECD: What it is, and its AI Data Focus

- Nebius: Stock, Coreweave, & Nvidia – What's the Real Deal?

- Bitcoin: Beyond the Headlines, What This Moment Truly Signals

- Social Security Retirement: The Realities of Your Payouts and How to Plan

- Starlink Satellites: How Many Are Really Up There, Where They're Hiding, & What's The Actual Point?

- Tag list

-

- carbon trading (2)

- financial innovation (2)

- blockchain technology (2)

- carbon tokens (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (29)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (7)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Aster (8)

- Zcash (6)

- iren stock (3)