Beyond Meat's Stock Surge: Just another meme stock rally that's already over

TITLE: Beyond Meat’s 900% Stock Surge Wasn’t a Comeback. It Was a Ghost Story.

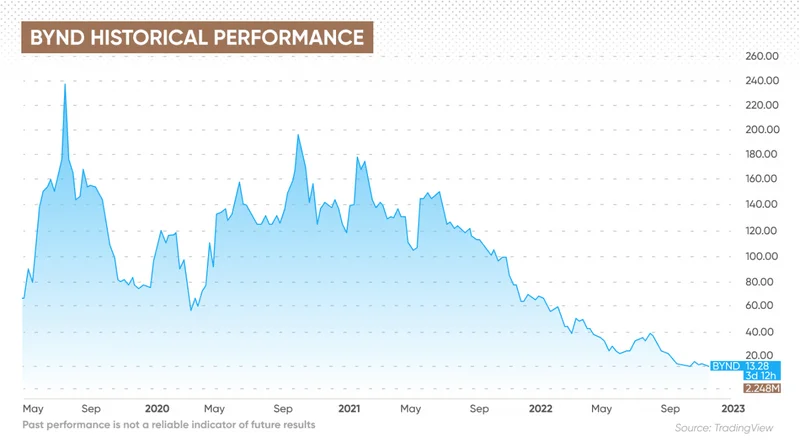

So, let me get this straight. A company whose stock peaked at over $230 a share, then cratered to a pathetic 65 cents, suddenly becomes the hottest ticket on Wall Street? For a few days, at least. Beyond Meat, the poster child for plant-based promises that never quite delivered, just had a 900% rally.

Give me a break.

This wasn't a comeback story. This was a séance. A bunch of bored retail traders, armed with a resurrected meme stock ETF, decided to summon the ghost of 2021 for one last, spastic dance. And for 72 glorious, chaotic hours, the corpse actually twitched.

The Meme Machine Grinds Again

It all started, as these things always do, with a signal. Roundhill Investments, which had mercifully shut down its Meme Stock ETF (ticker: MEME) back in 2023 due to a stunning lack of interest, decided the world needed more pointless volatility. They brought the zombie fund back from the dead and, on Monday, added Beyond Meat to its holdings.

That was the bat-signal.

With more than 63% of Beyond Meat’s float being shorted, the stock was basically a giant pile of dry tinder waiting for a match. The shorts—investors betting the stock would go down—were over-leveraged and arrogant. The meme crowd saw blood in the water. They see a stock with high short interest and a recognizable name, and they just...

The rally was on. Matt Stucky over at Northwestern Mutual called it a “‘hope, dreams, themes, and memes kind of environment.” Let me translate that for you: it’s a casino where the roulette wheel is powered by Reddit threads and the house always, always wins. He also called it a "speculative kind of risk" led by unprofitable companies. You think? What does it say about the health of our economy when the most exciting stories aren't about innovation or profit, but about which failing company we can collectively pump before the floor gives out?

This entire episode is like finding a dusty old Ouija board in the attic of the stock market. You know you shouldn't mess with it, you know it’s just a dumb game, but you and your friends do it anyway. And for a brief, thrilling moment, the planchette actually moves. You convince yourself you're talking to the spirits of real financial opportunity. But you’re not. You're just pushing a piece of plastic around a board, spelling out your own doom.

A Three-Day Bender in Hell

By Tuesday, the frenzy was in full swing. The company announced an "expanded distribution deal" with Walmart, which was just enough of a flimsy narrative hook to justify the madness. The stock shot up 146% in its best day ever. Retail traders, according to Vanda Research, plowed nearly $35 million into the stock. A single-day record.

You could practically feel the static in the air, the hum of servers straining under the weight of a million degenerates hitting the “buy” button on their phones.

Then came Wednesday. The grand finale. The stock surged another 112% in the morning, hitting a high of $7.69. And right there, at the absolute peak, you could see the whole story of this ridiculous charade play out in a single WallStreetBets comment thread. One user posted that he’d bought 10,000 shares at $7.50. Another user replied, almost instantly: "Youre already down 7k, impressive."

That’s it. That’s the whole damn story. The rocket goes up, the rocket comes down. By the end of the day, Beyond Meat shares fall 1%, giving up a triple-digit gain as meme rally fizzles. The ghost went back in the machine.

This was just dumb speculation. No, "dumb" doesn't cover it—this was a collective, digitally-orchestrated seizure. A flash mob for idiots. I almost feel bad for the company, but then I remember they’re the ones who sold the public on a $230 stock that became a penny stock. This ain't some plucky underdog.

Then again, who am I to judge? Some people, the ones who got in at 65 cents and out at seven bucks, made a killing. Maybe I'm the crazy one for thinking a company's value should have some connection to, you know, its actual business.

It’s All Just a Game

Let’s be real, this isn’t 2021. Back then, there was a sense of anarchic glee, of sticking it to the hedge funds. It felt novel. Now? It just feels tired. Desperate. We’re watching reruns, and the jokes aren't funny anymore.

The fact that the catalyst was a revived, previously failed ETF tells you everything. The financial world is so devoid of actual ideas that it's just recycling its worst ones. We're stuck in a loop of nostalgia for a bubble that happened less than five years ago. It’s pathetic.

One user on WallStreetBets summed it up perfectly: "You know the economy is cooked when BYND stock is making a comeback." He was joking, but he was also telling the absolute truth. When the market's big winners are bankrupt car rental companies, dying video game retailers, and a fake meat company whose stock has fallen 98% from its peak, you’re not looking at a healthy system.

You’re looking at a circus. And we’re all clowns.

- Search

- Recently Published

-

- Duke Energy: What's Really Going On?

- Value City Furniture: Are they finally going out of business? The bankruptcy talk.

- Scott Bessent: Who Is This Guy, The Trump Whispers, And What Are They Not Telling Us?

- American Signature Files Chapter 11: What Happened?

- Tesla Ride-Hail in Arizona: What This Means for the Future of Mobility

- OECD: What it is, and its AI Data Focus

- Nebius: Stock, Coreweave, & Nvidia – What's the Real Deal?

- Bitcoin: Beyond the Headlines, What This Moment Truly Signals

- Social Security Retirement: The Realities of Your Payouts and How to Plan

- Starlink Satellites: How Many Are Really Up There, Where They're Hiding, & What's The Actual Point?

- Tag list

-

- carbon trading (2)

- financial innovation (2)

- blockchain technology (2)

- carbon tokens (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (29)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (7)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Aster (8)

- Zcash (6)

- iren stock (3)