The XRP Price Circus: Whale Games, Legal Hype, and Why You're Getting Played

So a tweet from a former president sends the crypto world into a $19 billion nosedive, and everyone acts surprised. Give me a break.

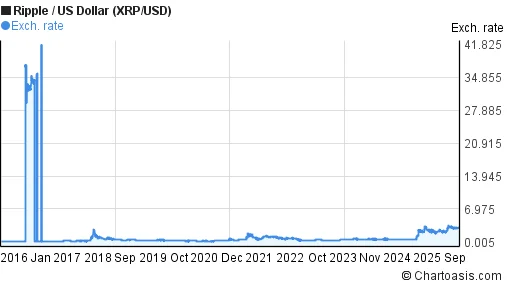

You watched it happen. One minute, XRP is flirting with three bucks, and the so-called "XRP Army" is busy photoshopping rockets onto their profile pictures. The next, a 100% tariff threat hits the wire and the whole house of cards collapses. A 46% drop. Billions of dollars in leveraged bets vaporized in a single afternoon. Over $700 million in XRP positions alone, gone. Poof.

And what do we hear? "It's a black swan event!" "It's a healthy correction!"

This was a market correction. No, a 'correction' doesn't cover it—this was a five-alarm dumpster fire. It was a calculated shakedown, and if you didn't see it coming, you haven't been paying attention.

They Knew It Was Coming

Let's be real. While the diamond-handed retail crowd was chanting HODL and buying the dip, the real money was already heading for the exits. The data doesn't lie. Whales—the crypto equivalent of old-money billionaires—dumped 440 million XRP in the month leading up to this. That’s over a billion dollars. They weren't panic-selling; they were distributing their bags to the starry-eyed believers who were sure the ETF approval was just around the corner. XRP Price Forecast - XRP-USD Recovers to $2.44 After $19B Liquidation and 440M Whale Selloff - TradingNEWS

And speaking of that ETF, how convenient is it that a good ol' fashioned government shutdown puts the SEC on ice? All those applications from BlackRock, Grayscale, and the rest of the Wall Street suits are now gathering dust. The one catalyst everyone was banking on to send XRP to the moon has been delayed indefinitely. It’s almost poetic, in a dark, twisted way. It’s the kind of predictable chaos that Washington specializes in, yet every time it happens, the market acts like it’s a total shock.

This whole setup feels less like an unfortunate series of events and more like a perfectly executed play. The whales cash out at the top, a macro event provides the perfect cover story for a crash, and the government conveniently hits the pause button on the only piece of good news on the horizon. It's a beautiful, brutal machine. So, my question is, who was on the other side of those whale trades? Who was buying a billion dollars' worth of XRP right before it was about to get cut in half?

The Casino Is Now Open

In the middle of the carnage, you could almost hear the clicking of mouse buttons from Switzerland. While retail traders were getting margin called, reports show that European and Swiss institutional investors were "aggressively accumulating" XRP in the low $2 range.

This is the part of the movie where the game is revealed. The market is a giant poker table. The whales are the pros who know when to fold. The retail army are the tourists, shouting their strategy out loud for everyone to hear. And the institutions? They're the house, quietly scooping up the chips after a big, messy hand. They’re buying the blood in the streets, confident that another wave of hype is just around the corner.

And why wouldn't they be? The analysts are already back on their soapboxes. You've got Standard Chartered calling for $12. You've got Peter Brandt calling it a "short candidate." You've got Bloomberg analysts saying there's a 100% chance of an ETF approval… eventually. It's a cacophony of noise designed to keep you confused and emotional. It ain't about fundamentals or technology, and it certainly ain't about "banking the unbanked." It's about volatility. It's about creating enough chaos to shake out the weak hands and transfer their wealth to the patient ones.

Offcourse, the price has stabilized around $2.40. The true believers will call this a sign of strength. But what is it really? Is it a new floor, or just a ledge on the way down? The on-chain data shows selling pressure from large holders persists, even now. The whole system is designed to... well, you get the picture.

So We're All Just Gambling, Right?

Let's stop pretending this is about anything other than pure, unadulterated speculation. The SEC settlement, Ripple’s stablecoin, the ODL network—that’s all just window dressing for the casino. The flash crash wasn't a bug; it was a feature. It’s the mechanism that keeps the game interesting and profitable for the people at the top. The promise of an ETF is the carrot, the crash is the stick, and everyone else is just stuck in the middle, hoping they bet on the right color. Maybe I'm the crazy one, but it seems pretty clear who's really running the table. And it sure as hell isn't the guy with diamond hands in his Twitter bio.

- Search

- Recently Published

-

- Duke Energy: What's Really Going On?

- Value City Furniture: Are they finally going out of business? The bankruptcy talk.

- Scott Bessent: Who Is This Guy, The Trump Whispers, And What Are They Not Telling Us?

- American Signature Files Chapter 11: What Happened?

- Tesla Ride-Hail in Arizona: What This Means for the Future of Mobility

- OECD: What it is, and its AI Data Focus

- Nebius: Stock, Coreweave, & Nvidia – What's the Real Deal?

- Bitcoin: Beyond the Headlines, What This Moment Truly Signals

- Social Security Retirement: The Realities of Your Payouts and How to Plan

- Starlink Satellites: How Many Are Really Up There, Where They're Hiding, & What's The Actual Point?

- Tag list

-

- carbon trading (2)

- financial innovation (2)

- blockchain technology (2)

- carbon tokens (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (29)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (7)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Aster (8)

- Zcash (6)

- iren stock (3)