ChainOpera AI: The Real Risks vs. The CoinMarketCap Hype

Let's get one thing straight. When a crypto token like ChainOpera AI (COAI) rips off a 1,300% gain in a week, my first thought isn't "Wow, what a great project." My first thought is, "Okay, who's getting played here?"

Because that's what this is. It's a game. And right now, the scoreboard is flashing with some truly insane numbers. A 64% jump in 24 hours. A market cap that exploded past a billion dollars in under a month. Everyone's patting themselves on the back, high on the fumes of "BNB Season," pointing to listings on Bybit and Aster Exchange as proof of legitimacy. It’s the kind of vertical chart you see on X that makes people empty their savings accounts.

I can almost picture it: some kid, bathed in the blue glow of his monitor at 2 AM, watching the price of COAI tick up, heart pounding. He sees the hype, the "top performer" accolades from Binance Alpha, and thinks he's found the one. He's found his ticket.

But he hasn't found a ticket. He's found a tripwire.

The Illusion of a Rocket Ship

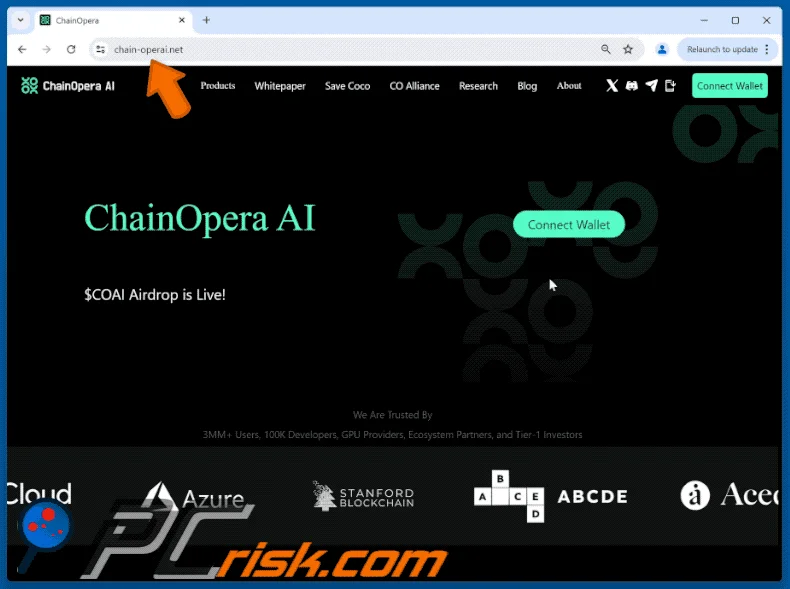

The narrative they're selling is seductive. ChainOpera AI claims to be a "decentralized AI platform" for "collaborative intelligence." It’s a word salad of buzzwords designed to sound revolutionary. It sounds like something a marketing intern cooked up after three espressos and a brainstorming session with a thesaurus. They boast over 3 million AI users and 300,000 paying customers for their app. Impressive, right?

But here’s the thing about narratives: they’re stories. And stories can be used to explain things, or they can be used to hide things.

This whole thing feels like a magic trick. The magician wants you to focus on the flashy price action, the "BNB Season" tailwind, the impressive user numbers. He’s waving his right hand, shouting about decentralized AI and paradigm shifts. But you should be watching his left hand. What is his left hand doing? It’s quietly holding 96% of the cards in the deck.

Think of the COAI market as a Jenga tower. In a healthy game, the blocks are distributed. Everyone pulls a piece, and the tension is real but shared. This ain't that. This is a Jenga tower where one guy owns all but a handful of the blocks. He can pull any piece he wants, whenever he wants, and the entire structure stays standing only because he allows it to. You, the retail investor, are just watching from the sidelines, betting on which way it will fall when he finally gets bored.

So when they talk about liquidity from new exchange listings, what are we really talking about? Is it genuine market interest, or is it just opening up more doors for the eventual, catastrophic exit?

Let's Talk About Who Really Owns This Thing

This is where the story goes from a speculative gold rush to a five-alarm dumpster fire. Let's look at the tokenomics, the part everyone skips because it's boring. The total supply of COAI is a billion tokens. Fine. But only 19.6% of that is even in circulation. The rest is... somewhere else. Waiting.

It gets worse. The top 10 wallet addresses hold over 96% of the total supply. Let me say that again so it sinks in. Ten wallets. The top 100 wallets control 99.74%.

This isn't a bad sign. No, "bad" doesn't cover it—this is a mathematical certainty of future disaster. This isn't decentralization; it's a digital monarchy. We don't know who owns these wallets. Is it the development team? A few early "investors"? A single whale with a dozen accounts? We have no idea, and that silence is deafening.

Some brave soul on X laid it out perfectly: "If these wallets dump, the price could collapse to zero... in seconds." He’s not being hyperbolic. He's just doing the math. The entire billion-dollar valuation is a mirage, propped up by a handful of accounts that could obliterate it with a few clicks. And offcourse, when they do, the people left holding worthless bags will be the same ones cheering the pump right now. This concentration of ownership is the primary answer to the question, What Are The Risks of Buying ChainOpera AI (COAI) in October? - BeInCrypto.

So what's the real product here? Is it a decentralized AI platform? Or is the product the token itself, and the customers are the people buying it on the open market, providing the exit liquidity for the insiders? It's a brutal question, but you have to ask it. Are 40,000 of their paying app users really converting into active COAI participants, or is that just another convenient number to prop up the illusion of organic growth? Then again, maybe I'm the crazy one for not believing in fairy tales.

So, Who's Holding the Detonator?

Forget the price on CoinMarketCap. Forget the 1,300% gains. All of it is noise. The only number that matters is ten—the ten wallets that control this entire ecosystem. The COAI token isn't an investment; it's a hostage. The only question left is when the holders decide to pull the trigger. This isn't a moonshot. It's a time bomb, and the clock is ticking.

- Search

- Recently Published

-

- Duke Energy: What's Really Going On?

- Value City Furniture: Are they finally going out of business? The bankruptcy talk.

- Scott Bessent: Who Is This Guy, The Trump Whispers, And What Are They Not Telling Us?

- American Signature Files Chapter 11: What Happened?

- Tesla Ride-Hail in Arizona: What This Means for the Future of Mobility

- OECD: What it is, and its AI Data Focus

- Nebius: Stock, Coreweave, & Nvidia – What's the Real Deal?

- Bitcoin: Beyond the Headlines, What This Moment Truly Signals

- Social Security Retirement: The Realities of Your Payouts and How to Plan

- Starlink Satellites: How Many Are Really Up There, Where They're Hiding, & What's The Actual Point?

- Tag list

-

- carbon trading (2)

- financial innovation (2)

- blockchain technology (2)

- carbon tokens (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (29)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (7)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Aster (8)

- Zcash (6)

- iren stock (3)