Solana Price Decline: ETF Inflows vs. Bearish Market

Solana's $199M ETF Inflows: A Drop in the Bucket?

Solana's price recently dipped below $180, a concerning signal even as its ETFs raked in nearly $199 million in a single week. The immediate reaction might be to celebrate the institutional interest, but let's dissect these numbers. Is this influx truly significant, or is it just noise in a larger, more turbulent market?

The Macroeconomic Headwind

The current Solana price hovers around $175, a 6.4% daily drop and a 12% correction over the past week. Despite the ETFs from Bitwise, Grayscale, and 21Shares pushing total assets past $500 million, the price hasn’t stabilized. Analysts are quick to point to a "risk-off sentiment" in global markets, spurred by skepticism over Trump's tariff announcements (tariffs are taxes, after all, and markets hate uncertainty).

While macro instability is a convenient scapegoat, it's crucial to examine Solana's fundamentals. The blockchain boasts annualized revenue of $2.85 billion, growing almost 30% faster than Ethereum in its early days. Western Union is even building a stablecoin on Solana for global remittances. But here's the rub: revenue and potential partnerships don't always translate to immediate price stability.

Technical Indicators and Cautionary Signals

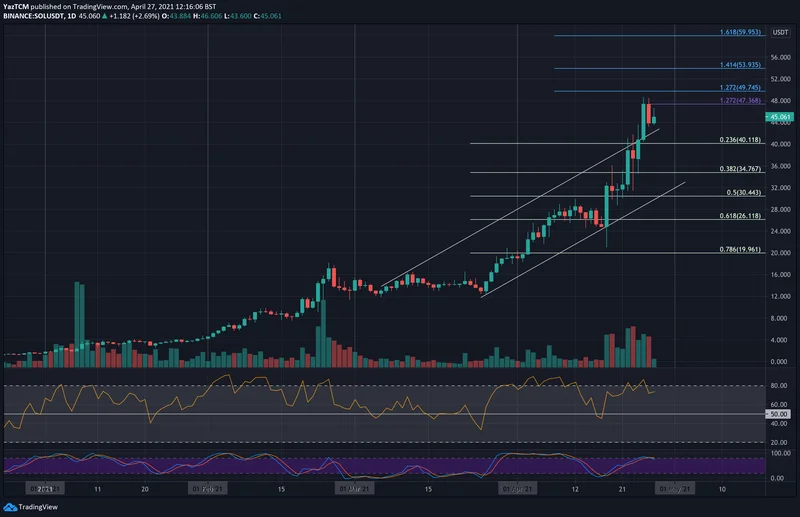

Short-term traders are clearly wary. Technical indicators show Solana consolidating below major moving averages, with support around $172 and resistance between $188 and $192. The RSI (Relative Strength Index) is nearing oversold levels at 41, and the MACD (Moving Average Convergence Divergence) hints at weakening selling pressure.

But these are just indicators, not guarantees. A break below $172 could trigger a further drop to $157 or even $142. Conversely, holding the 200-day moving average at $179.78 and reclaiming the $189–$200 range could reignite bullish momentum. It's a tug-of-war, and the outcome is far from certain.

Lark Davis, a well-known analyst, argues that Solana is "winning" against Ethereum in speed, scalability, and user growth. Long-term investors remain optimistic that institutional inflows and Solana's expanding ecosystem will eventually boost its price. But optimism doesn't pay the bills. We need to see concrete evidence that these factors are outweighing the broader market pressures.

And this is the part of the report that I find genuinely puzzling. The price should be reflecting these inflows, shouldn't it? A $199 million injection should have at least provided some price support, even if it didn't trigger a massive rally. The discrepancy suggests that either the inflows are being offset by even larger outflows from other sources, or that the market has already priced in these inflows.

The broader crypto market weakness is also a factor. Bitcoin's decline below $108,000 has dragged down altcoins, including Solana. A rebound in BTC above $110,000 could provide a much-needed lift, but until then, SOL is likely to consolidate within a narrow range.

Analyst Ali's chart highlights Solana's multi-month range between $100 and $260, suggesting a possible downward trajectory if the $158–$165 support fails. The projections indicate a potential short-term rebound to $200 before a continued downtrend, possibly pushing SOL toward the $130–$100 zone by early 2026. It's a lower-high structure consistent with bearish continuation, unless buyers break above $200 decisively.

Solana's total value locked (TVL) has surpassed $10 billion, and its stablecoin market cap is around $14.5 billion. However, these figures don't tell the whole story. TVL can be inflated by various factors, including wash trading and incentivized staking. Key facts: Solana's price drops 8% amid market decline; TVL exceeds $10B

What the Future Holds

Solana's short-term outlook remains bearish, but its long-term fundamentals offer hope. The $165 demand zone is critical. Holding above it could reignite buying pressure and set the stage for a retest of $200. But if market sentiment worsens and BTC remains weak, SOL could face further downside before a sustainable recovery emerges.

ETF Inflows: A Mirage?

The $199 million ETF inflow is substantial (reported at $198.9 million to be more exact), but it's not a magic bullet. It's a single data point in a complex equation, and it's being overshadowed by macroeconomic headwinds and broader market weakness. Until we see a sustained rebound in BTC and a clear break above the $200 resistance level, Solana's price is likely to remain under pressure.

- Search

- Recently Published

-

- Duke Energy: What's Really Going On?

- Value City Furniture: Are they finally going out of business? The bankruptcy talk.

- Scott Bessent: Who Is This Guy, The Trump Whispers, And What Are They Not Telling Us?

- American Signature Files Chapter 11: What Happened?

- Tesla Ride-Hail in Arizona: What This Means for the Future of Mobility

- OECD: What it is, and its AI Data Focus

- Nebius: Stock, Coreweave, & Nvidia – What's the Real Deal?

- Bitcoin: Beyond the Headlines, What This Moment Truly Signals

- Social Security Retirement: The Realities of Your Payouts and How to Plan

- Starlink Satellites: How Many Are Really Up There, Where They're Hiding, & What's The Actual Point?

- Tag list

-

- carbon trading (2)

- financial innovation (2)

- blockchain technology (2)

- carbon tokens (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (29)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (7)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Aster (8)

- Zcash (6)

- iren stock (3)